Every 90 days, publicly traded companies provide investors with updated earnings and forward outlook.

They’re required to by law. And they have been since the 1930s.

Think of it as a quarterly progress report…

It’s a way of leveling the playing field between those “in the know” and everyday Americans who may want to invest in a company but don’t have the CEO’s ear.

With these quarterly reports, everyone gets the same information at the same time. (How investors act on it is another story…)

Before these quarterly reports existed, Wall Street was where enormous fortunes could be made or lost thanks to incomplete or private information.

That means it was essentially a wealthy investor’s game since they could get the information they needed.

Most Americans didn’t invest in stocks. The odds were stacked against them. The uncertainty was too high.

Having these quarterly reports gives investors confidence in the markets. That’s led to the rise of millions of Americans owning and investing in stocks.

Today, I want to share a similar progress report.

Instead of focusing on financial numbers, however, I want to share something more valuable: the top strategies for today’s markets.

Remember, at Banyan Hill, we’re a group of elite financial experts who make investing simple, fun and profitable for those who desire more … more knowledge, more money, more opportunities.

To do that, we have experts who employ various strategies.

Right now, we have four gurus employing 15 strategies.

Some of these strategies involve buying and holding tech stocks for years on end; others involve buying an option on Monday … and getting out of it on Wednesday.

So, which strategies are doing the best right now? What strategies will be the best for the rest of 2024?

With the first quarter wrapping up, it’s the perfect time to think about how to invest through the rest of the year.

Today, I want to share the top three strategies from our experts that will help you beat the market through the rest of the year.

We’ll start with our top buy-and-hold strategy, then look at our top trading strategy, and finally look at our top speculative strategy.

Top Buy & Hold Strategy: Alpha Investor

For a fantastic strategy to buy and hold great stocks rather than trade in and out, look no further than Alpha Investor.

Charles Mizrahi is the expert here. He uses what he calls the “Alpha-4 Approach” to find winners – companies that can beat the market for years.

- Alpha Market: The stock needs to reside in a market sector in the early innings of a massive, multi-year rally.

- Alpha Management: Great management can result in better returns than mediocre management. As Charles says: “Bet on the jockey, not the horse.”

- Alpha Money: Does the company have a strong balance sheet? Is it capable of delivering massive returns to shareholders? If so, it’s worth buying.

- Alpha Price: Shares need to trade at a great price, as offered by Mr. Market. Overpaying gets investors into trouble — and the market often overlooks excellent bargains.

This simple four-factor strategy allows Charles to find companies that can outperform the overall market over a few years.

And it works amazingly.

In the Alpha Investor portfolio, Charles is up on 97% of his stock picks.

Many of those positions are up well over 100% since we started the service five years ago, including:

- A 103% gain on a logistics company that has benefitted from AI.

- A 106% gain on semiconductor stock positions to rise from AI.

- A 143% gain on a Big Data company.

- A 244% gain on major health care player.

- A 249% gain on tech company.

- A 261% gain on investment firm.

- And 653% on another AI play.

Since Alpha Investor’s inception in 2019, the S&P 500 has had a total return of 114.3%. Alpha Investor members have seen a 186.8% return. That’s 63.4% better.

Alpha Investor positions are poised for further market-beating profits. Without day trading. Without leverage.

Just great companies, bought at the right time, at the right place, and with the right management in place. And then holding.

The best way to learn more about the Alpha Investor is to watch the latest interview with Charles about his AI strategy.

Top Trading Strategy: Profit Accelerator

As you’ve just seen, Charles Mizrahi is one of our top buy-and-hold experts.

He’s helped investors see gains of 249%, 261% and 653% on some of his top picks.

That’s why, for many, it was a shock when Charles revealed his Profit Accelerator strategy last December.

It’s an AI-powered system designed to beat the market 5:1 using a trading strategy, not a buy-and-hold one.

Here’s how it works:

It screens through the top 2,200 stocks in the market.

In the span of a few seconds, this AI-powered system screens out companies in a downtrend … or that have bad financials.

The result? A handful of companies that are strong operationally … and trending higher.

That narrows the universe of stocks to a list of about 240.

From there, Charles buys the top 10 positions with the strongest momentum.

Every four weeks, the screen gets rerun.

And if a company’s momentum has declined, it’s out. And a new position is in.

On its inception on December 13, Charles came up with an initial list of 10 stocks.

Since then, he’s run the system three more times.

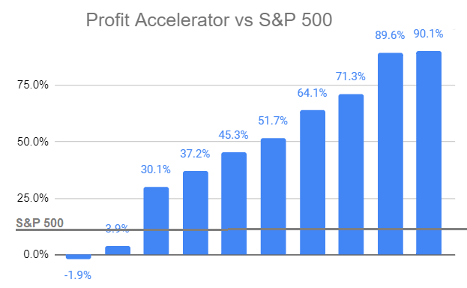

Overall, the Profit Accelerator strategy is up 48%.

The stock market is up about 11% over the same period.

That means Charles is beating the market by nearly 5X — exactly what the system is designed to do.

Here’s a chart of the exact gains of each position…

The grey line is the S&P 500.

The blue bars are the ten positions in his portfolio.

As you can see, eight of the ten are beating the market, some by 9X.

Note: This chart is not quite complete. It does not include the one position Charles closed out: CymaBay Therapeutics (Nasdaq: CBAY).

It made a 50.6% profit in two months. The stock market was up less than 10% over the same period, making for a 5X gain.

Imagine being able to beat the market by 5X consistently…

That means being able to 5X your retirement plans. Instead of hitting $1 million, you could grow your nest egg to $5 million.

Whatever your financial goals are, being able to reach them 5X faster is life-changing.

For investors who feel like they’ve missed out on this market and need to catch up, Profit Accelerator allows you to do so without taking on excessive risks.

New membership to this service is closed right now. However … I asked my team to open it up for the day.

Check out what Charles has to say about Profit Accelerator and how you can put it to work here.

Top Speculative Strategy: Next Wave Crypto Fortunes

The hottest market of the year has been cryptocurrency.

Bitcoin (BTC) is up over 44% year-to-date. That’s on top of the triple-digit gains bitcoin saw in 2023.

Thanks to the approval of 11 bitcoin ETFs in January, demand has surged as institutional investors have been able to buy in.

Bitcoin even made a new all-time high of over $73,000 in mid-March.

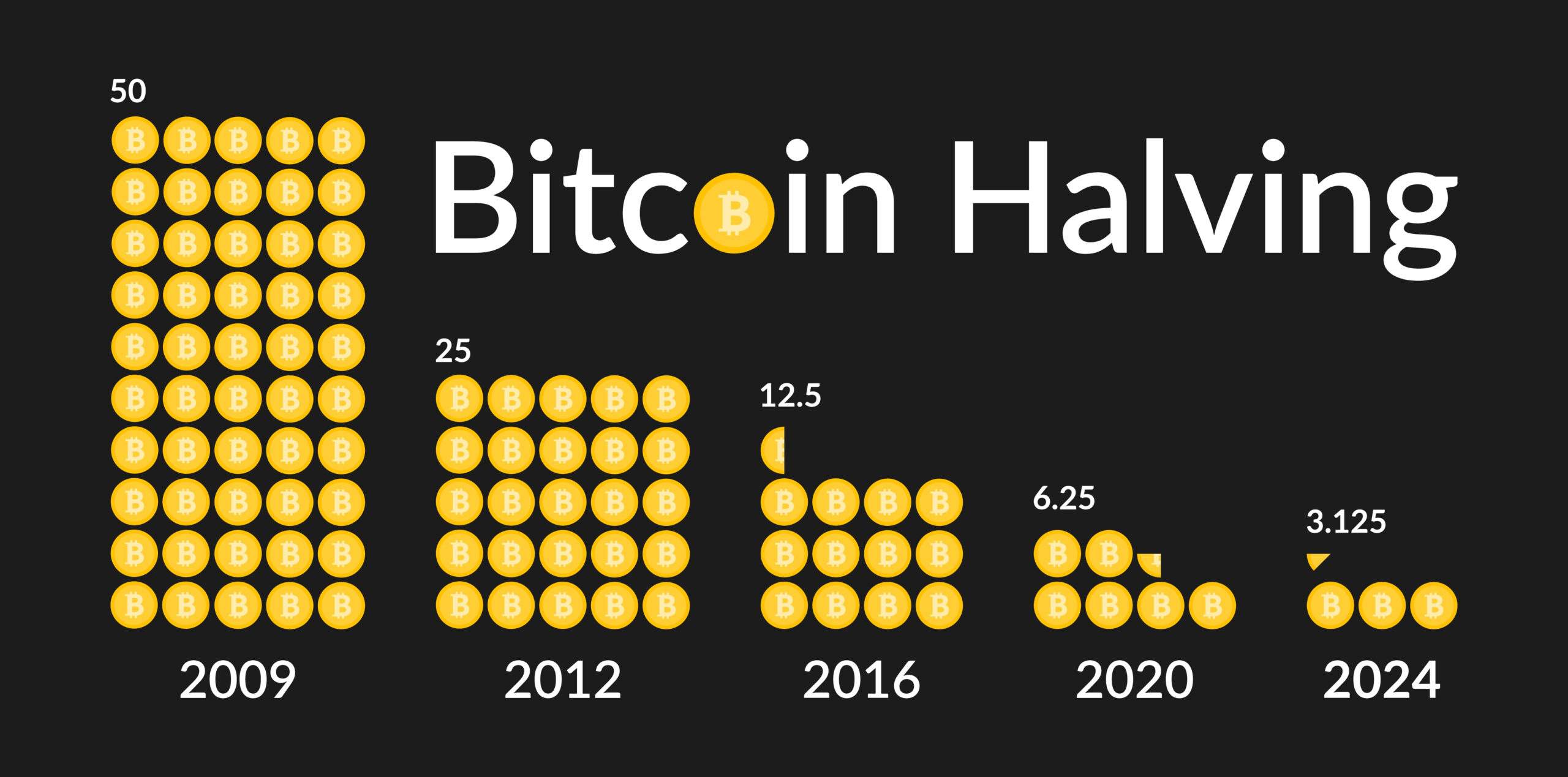

This is also attributed to the upcoming bitcoin halving, which is supposed to happen in mid-April.

The halving is when the new supply of bitcoin is reduced by 50%. It occurs approximately every four years.

And the next halving is just weeks away…

The combination of higher demand (from the ETFs) and lower new supply (from the halving) could make for a massive year!

That’s helped bitcoin’s rally this year. And it was up as much as 67% at its peak.

Meanwhile, Ethereum (ETH) is up 38% year-to-date. At its peak, it was up 74%.

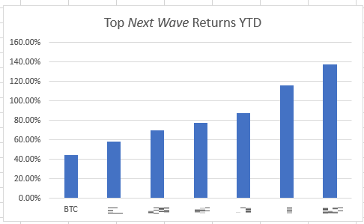

Yet, Ian is doing even better.

Since the start of the year, a few of Ian’s recommendations are up 58%, 70%, 77%, 87%, 116% and 138%.

Again, that is since the start of the year!

This list also doesn’t include the fact that Ian made a massive gain by selling a part of the position in Solana (SOL), resulting in a 9,781% gain.

This profit didn’t happen overnight.

Ian first recommended the trade on December 17, 2020.

About a year later, Ian advised members to take 50% of the position off the table for a 1,975% profit. And Ian took those profits right as bitcoin and Ethereum were hitting their peaks.

Looking forward, Ian still sees more upside for bitcoin and other major cryptocurrencies this year.

Ian’s latest research indicates that the most significant profits haven’t been made yet. That’s because we haven’t had bitcoin’s fourth halving. That’s set to occur in late April.

Bitcoin halvings cut new BTC supply in half. Each of the three prior halving events has led to massive price jumps.

But on a percentage basis, altcoins have done better. That’s why Ian’s managed to earn nearly 10,000% in Solana, or 100X over a period when bitcoin rose only about 5X.

And during the last halving cycle, Ian did even better. He even managed to lock in an 18,000% gain.

With this trend about to play out again, the rest of 2024 could offer some mind-boggling returns.

And Ian’s approach of taking partial profits along the way helps take some of the sting out of the crypto market’s wild swings.

Again, the crypto market is already soaring this year. But we likely haven’t seen the best returns yet in bitcoin, Ethereum, and the altcoins.

That’s why it’s critical to stay up to date with Ian’s latest research. Go here to see his urgent update on bitcoin’s upcoming fourth halving.

Which Strategy Will You Employ?

Using any one of these strategies can help you not just profit in today’s market but for years to come.

If you prefer to take a buy-and-hold approach, Alpha Investor’s got you covered. You don’t have to settle for slow-and-steady gains that mimic the market. You can get far better returns without having to trade. Go here to watch that interview with Charles about his latest AI strategy.

If you like the idea of a trading service that can help you beat the market 5 to 1, Profit Accelerator will ensure you only invest in the top companies with strong momentum. Go here to see Charles’ presentation on how this works.

And if you want to profit from this year’s crypto rally without risking your money on altcoins with no real projects behind them, Next Wave Crypto Fortunes offers the best opportunity. Go here to see how you can profit from bitcoin’s fourth halving.

CEO, Banyan Hill, Money & Markets